Reasons to buy Global Bank Baron Bond DAFITM

100% Principal Protection

for qualified investors through the accrual of A2/A globally rated bank collateralization accruals.

Tailor-structure

of credit quality, maturities and cashflow streams for your unique requirements. Tell us what you need, and we will put some of our best and brightest on Wall Street to work structuring for you. A 15-year tenor is what you need and a A2/A credit, no problem, remember, 5 to 35-year bespoke maturities are possible, too.

For a 15-year tenor indicative?

Baron Bond Global Bank DAFI™ Strategy could be structured to maintain a fixed [1.00]%(1) per annum, Annual Coupon in a ring-fenced A2/A global bank paper collateralization with 100% of the face value of the principal paid at maturity, secured at the Moody’s Aa2/P-1, S&P AA-/A-1+, Fitch AA/F1+ Custodian.

Superior enhanced yield

structured with risk mitigation. Baron Bond Global Bank Strategy match your plan or financial product arbitrage requirements [currently targeted in the 4.99 to 5.99 range]%(1) per annum Maturity Coupon paid as a bullet at maturity.

Custodian held assets

A global custodian rated Moody’s Aa2/P-1, S&P AA-/A-1+, Fitch AA/F1 always holds the assets of the Baron Bond Global Bank DAFI™ Strategy. Baron Bonds maintain a First Priority Security Interest, secured at a Custodian rated one-notch below the U.S. Treasury.

Bankruptcy Remote

All costs of maintaining the SP until legal maturity are paid forward with escrow or via a return stream guaranteed by a Bank rated Global A2/A+/A Moody’s/Fitch/S&P, or better.

Liquidity

A margin loan can be arranged for rapid liquidity, or the Baron Bond Global Bank DAFI™ Strategy can be Repoed via Euroclear or Clearstream.

Ring-fenced Maturity Coupon

Diversified Algorithmic Fixed Income Alternative™ Strategy

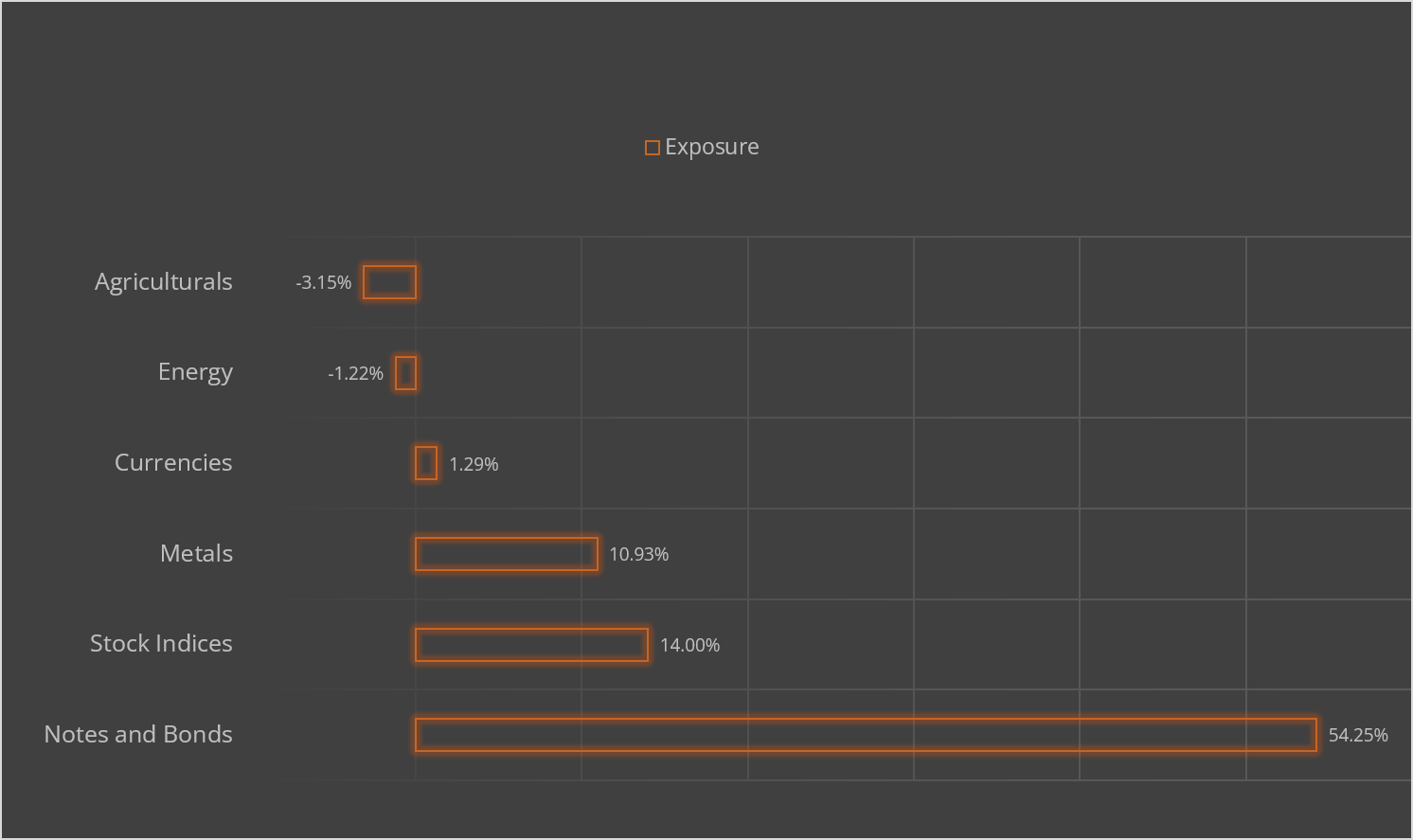

DAFI™ Asset Allocation

as of 12/31/25

Exposure

Secular long only U.S. Treasury, Stock, and Gold positions with cyclical commodity long/short components that hedge and produce stable return enhancement, in a A2/A Collateralization for the Principal Protection and the Annual Coupon—cashflows guaranteed for the life of the Note.

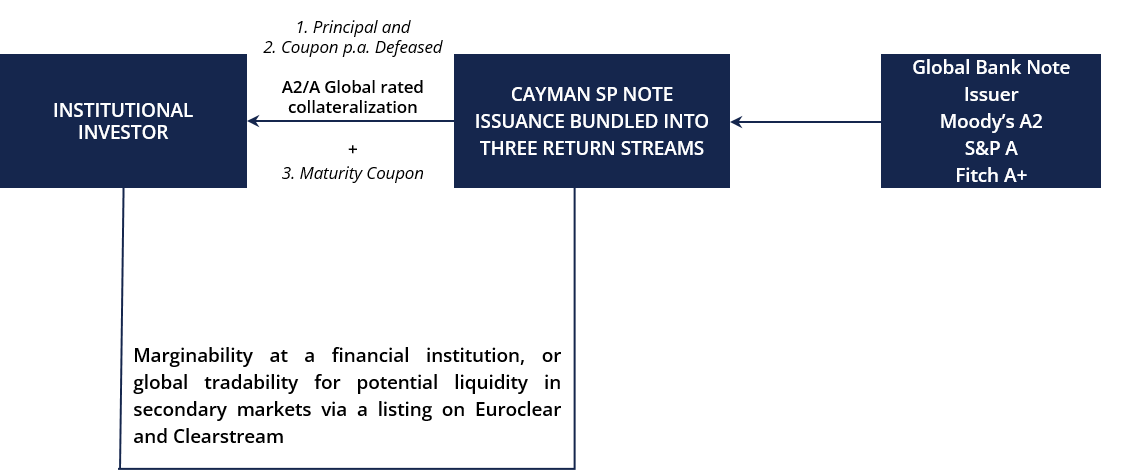

Overview of Global Bank Repack Transaction Flow and Structure

Baron Bond Global Bank Use Case

• A2/A Global Bank Collateralization

• Match Long-Dated Maturities versus Liabilities

• Grow book of product and plan participants

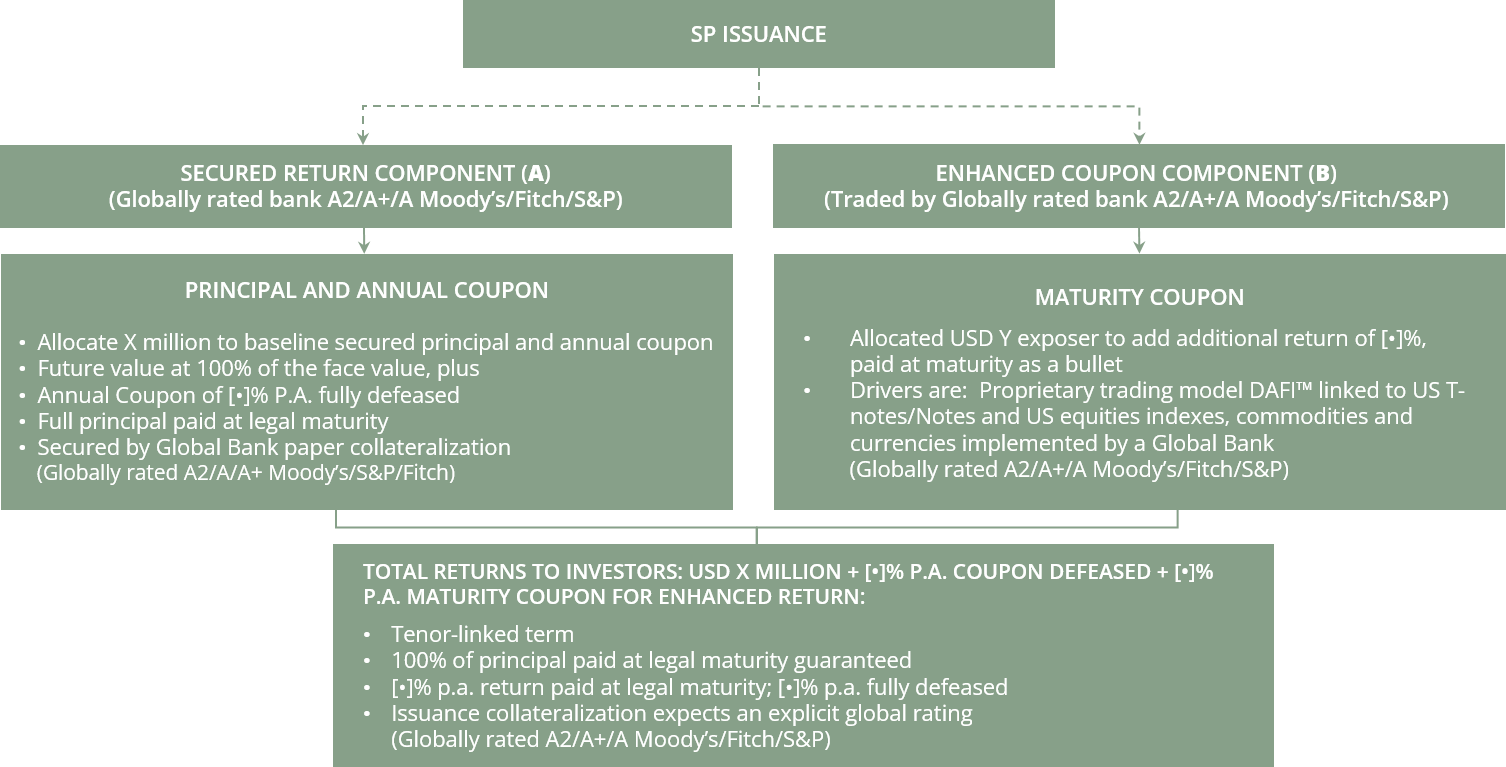

Overview of Global Bank Repack Capital Allocation

ENHANCED RETURN STREAM STATISTICS

(01/01/2004 – 12/31/2025)

Global Bank DAFI™ Strategy(1)

Annual Coupon, plus Maturity Coupon paid as a bullet at maturity

[currently targeted in the 5.99 to 6.99 range]%

Standard Deviation (Annualized)

8.68%

Gain Deviation (Annualized)

2.10%

Loss Deviation (Annualized)

1.50%

Indicative Term Sheet(1)

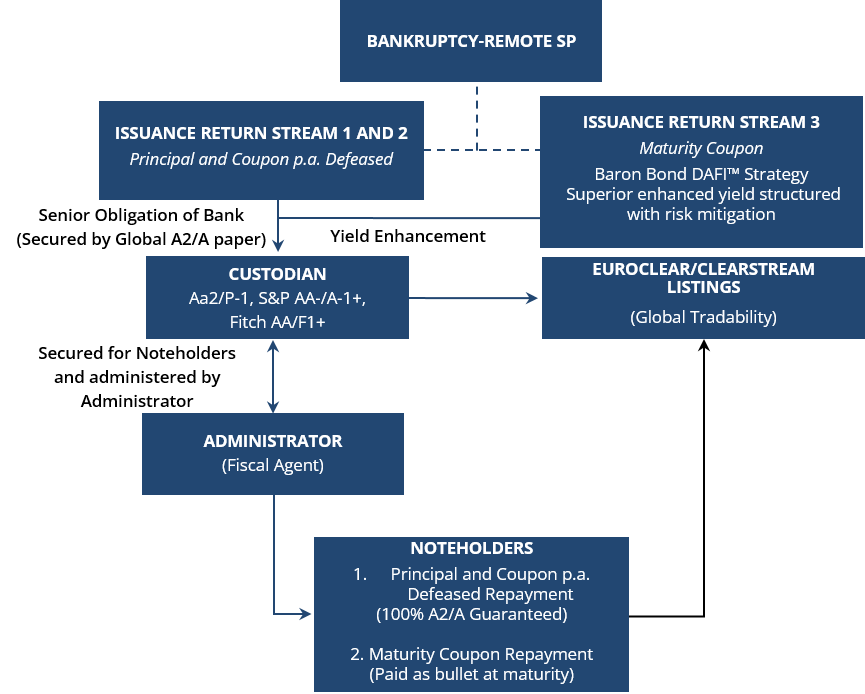

Overview

The Issuer will apply the net proceeds of the issuance of the Notes to (i) purchase an obligation issued by a Global Bank rated Moody’s A2, S&P A, and Fitch A+ (the “Global Bank Note”) which funds the full (100%) return of capital and the fixed [1.00] per cent per annum coupon paid out annually under the Notes (the “Annual Coupon”); and (ii) obtain exposure to a yield enhancement fixed coupon security equal [currently targeted in the 4.99 to 5.99 range] per cent per annum, paid out as a bullet payment on the Maturity Date (the “Maturity Coupon”)

Issuer

A Segregated Portfolio of a Cayman Island segregated portfolio company registered with the Cayman Island Monetary Authority (CIMA), other jurisdictions for a feeder SPV to be discussed

Amount

- US$ 250 million shelf registration

- US$ 50 million first subscriber

Tenor

15-year (5 – 25-year Bespoke maturities TBD)

Issuance Currency

United States Dollars (“USD” or “US$”)

Liquidity

Collateralized security exchangeable for cash

Principal and Maturity Coupon Payment

Bullet at Maturity. Annual Coupon paid out p.a.

Structure

Bankruptcy Remote SP is the issuer of the Global Depositary Notes (GDNs)

Reporting

Quarterly NAV (another periodicity TBD)

Expected Rating

Notes are expected to be globally rated A2/A Moody’s/S&P

Calculation Agent

Global Bank (A2/A+/A Moody’s/Fitch/ S&P)

Custodian

The Northern Trust Company (Moody’s Aa2/P-1, S&P AA-/A-1+, Fitch AA/F1+)

Administrator

SS&C Technologies LLC

AML/KYC Diligence

Walkers Corporate Limited

Legal Counsels

White & Case as to United States federal law; Loeb Smith as to Cayman law matters; Kinstellar Southeast Asia as to emerging markets jurisdictional law

Tax and Fiduciary

KPMG

Auditor

Ernst & Young

Investor Type

United States Securities and Exchange Commission (“SEC”) Rule 144 / Regulation S Qualified Institutional Buyers only (“QIB” or similar in international jurisdictions)

(1) Disclaimer: Pricing subject to final pricing, negotiation, terms and conditions as well as KYC and on-boarding. Any information contained herein is information owned by Baron Point Capital Management Ltd. (“Baron Point”), or its affiliates. Any references to any other third parties are not a representation of those parties’ ability or willingness to transact. This information should be reviewed and evaluated only in conjunction with the Offering Memorandum and/or any Supplement for any security being discussed. Any use, reproduction, dissemination, or disclosure of the information contained herein is strictly prohibited. Any presentation of any information transmitted on the web site is not intended as an offer or solicitation with respect to the purchase or sale of any security. Past performance is not necessarily indicative of future results and there can be no assurance that any security discussed by Baron Point will achieve comparable results. There is no representation by Baron Point that any examples of past investment activities or targets contained herein will be repeated on behalf of any or that, if they are, they will be successful. Investing in securities can be risky. In non-principal protected notes, an investor’s asset value may go up or down if not held to maturity. Baron Point offers no advice as to tax or regulatory implications. All investors should consult their own financial, legal, compliance, and tax advisors prior to investing.