Highlights

The DAFI™ Strategy Design

The DAFI™ strategy was designed for people in their retirement years, or for younger wealth creators seeking an absolute return strategy designed historically to be consistently up, year-over-year, with minimal downside impact and periods.

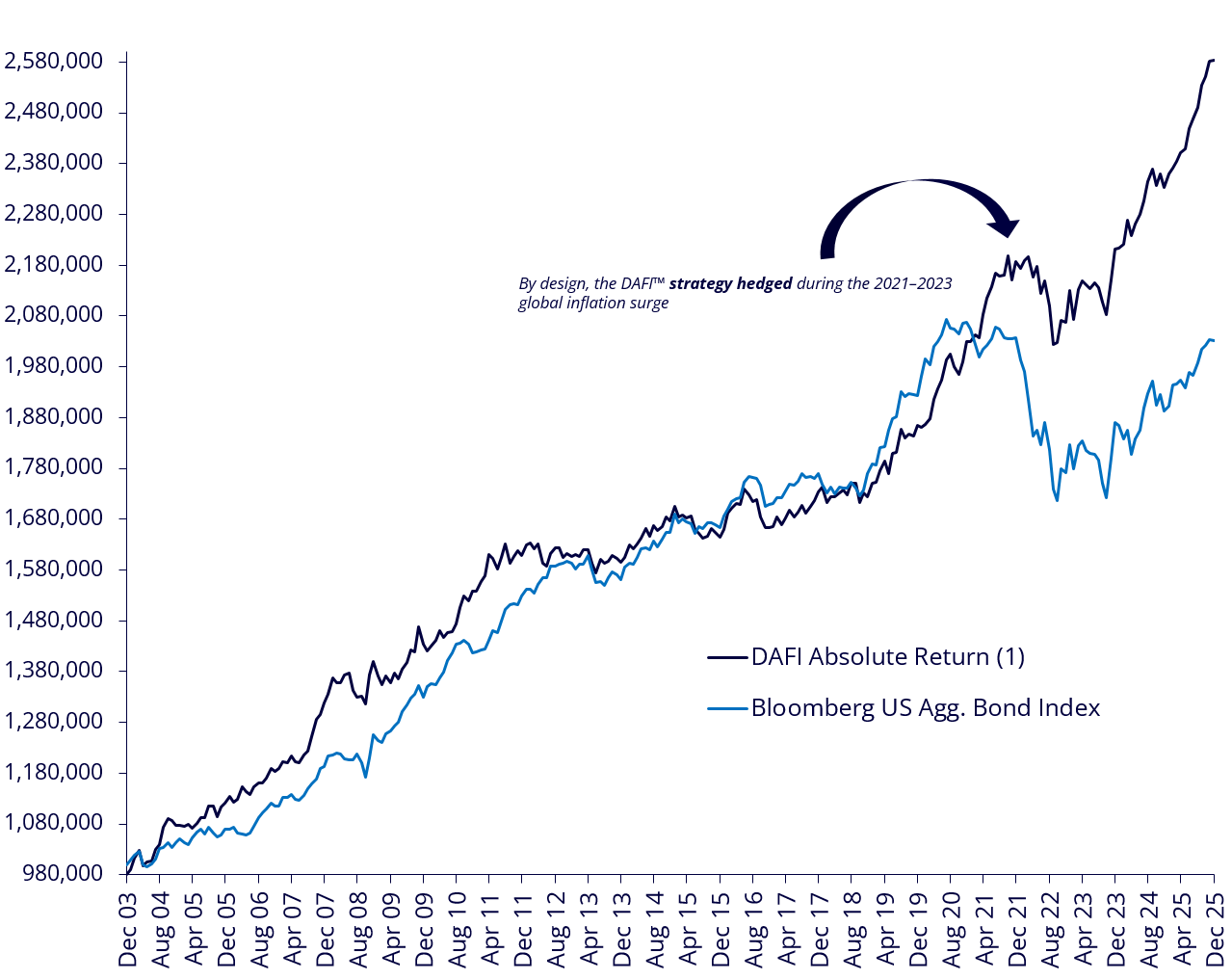

Performance and Inflation Hedge

The DAFI™ strategy seeks robust performance and was designed to hedge against inflation and thus, preserve wealth.

Proven Efficacy

The DAFI™ strategy again proves its efficacy during the 2021–2023 global inflation surge.

Systematic Rules-based Strategy

DAFI™ is a systematic rules-based strategy designed with potential besting the Bloomberg U.S. Aggregate Bond Index (AGG), the global standard investment-grade bond reference.

Without Credit Risk

The DAFI™ is without the credit risk associated with the AGG.

Characteristics

Potential characteristics are risk reduction, hedging against inflationary cycles and yield superiority in bond bull markets.

Reasons to Implement DAFI™ in Your Portfolio

Performance Alignment

Absolute return strategy heavily weighted to 5-year US Treasury Notes.

Real Economy Exposure

Rapidly responds to global economic movements—beyond single asset class proxies.

Systematic Long/Short Design

Implements a rules-based absolute return strategy using real economic price signals.

Efficient Portfolio Integration

Return enhancement over the baseline DAFI™ achieved by usage of minimal incremental exposure

Diversified Algorithmic Fixed Income Alternatives™

DAFI™ Absolute Return Strategy(1)

Monthly Logarithmic Net of 1% Management Fee Equity Graph

12/31/03 – 12/31/25

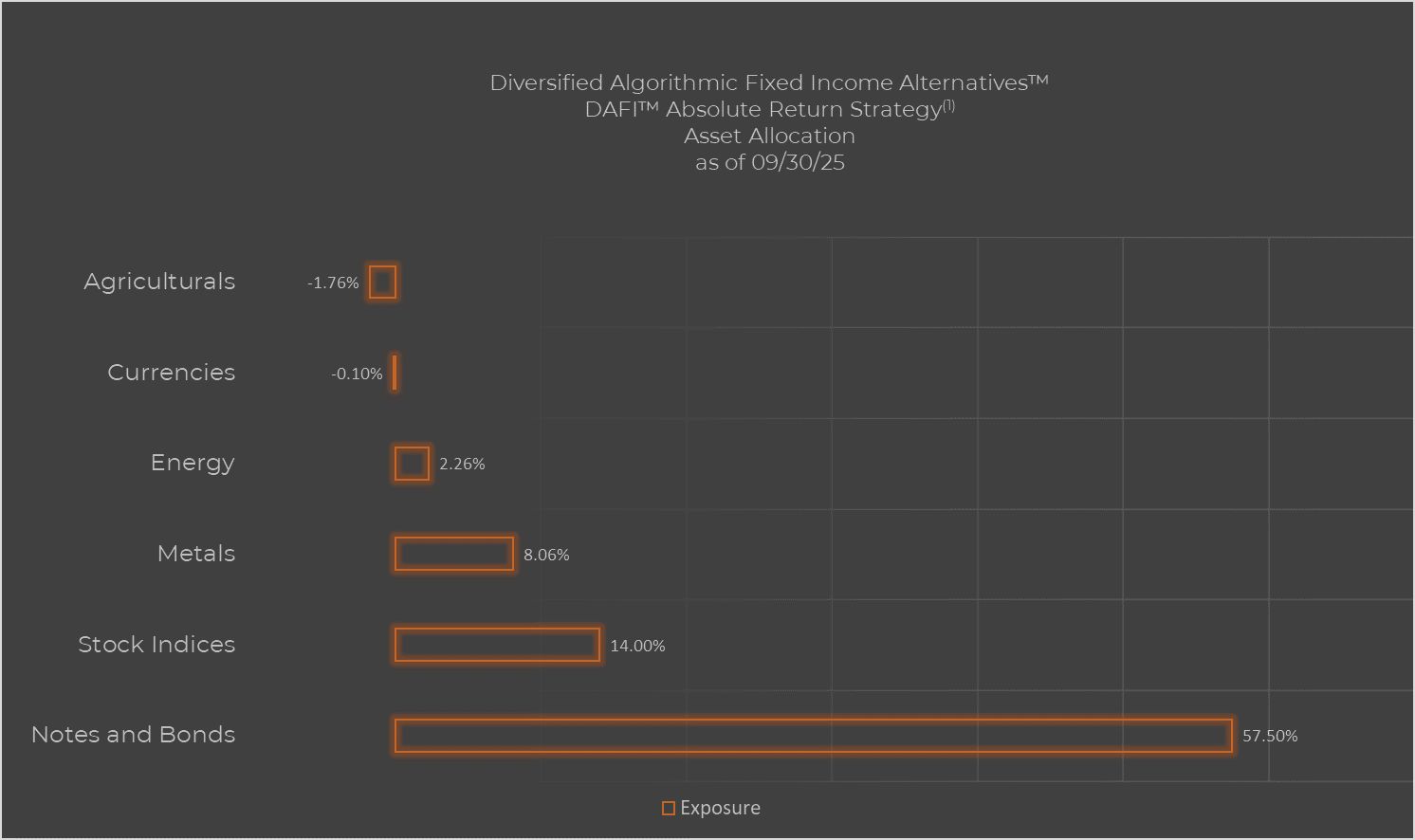

Exposure

Secular long US Treasury, Stock, and Gold positions, and long or flat Oil with cyclical commodity long/short components that hedge and produce stable return enhancement, in a A2/A Collateralization for the Principal Protection and the Annual Coupon—cashflows guaranteed for the life of the Note.

Use Case: Absolute Return at 1x Exposure Net of 1% Management Fee

RISK/RETURN STATISTICS

(12/31/2004 – 12/31/2025)

DAFITM

ABSOLUTE RETURN(1)

BLOOMBERG US

AGG. BOND INDEX

Compounded Return (Annualized)

4.51%

3.27%

Standard Deviation (Annualized)

4.34%

4.18%

Gain Deviation (Annualized)

1.09%

0.98%

Loss Deviation (Annualized)

0.72%

0.75%

Sharpe (RFR = 1.71%)

0.64

0.37

Sortino (MAR = 0.00%)

1.80

0.37

COMPARATIVE PERFORMANCE OVER TIME

2025 YTD

LAST 12 MONTHS

LAST 24 MONTHS

LAST 36 MONTHS

DAFI Absolute Return(1)

10.72%

10.72%

16.79%

25.01%

Bloomberg US Agg. Bond Index

7.30%

7.30%

8.64%

14.65%

COMPARATIVE ANNUAL PERFORMANCE

2025

2024

2023

2022

DAFI Absolute Return(1)

10.72%

5.48%

7.05%

-5.46%

Bloomberg US Agg. Bond Index

7.30%

1.25%

5.53%

-13.01%

(1)Disclaimer: Strategies on this website may have track records in other vehicles implementing those strategies at Baron Point Capital Management Group Ltd. (“Baron Point”), or otherwise. The Diversified Algorithmic Fixed Income Alternatives Strategy Family™, Diversified Algorithmic Fixed Income Alternatives Fund™, Diversified Algorithmic Fixed Income Alternatives SMA™, and Diversified Algorithmic Fixed Income Alternatives Portable Alpha™ (collectively “DAFI™” or the “Strategy”) return profiles from April 26, 2021, to Present, are based on values that have been released to the public and/or distributed internally, for example via websites, data feeds, fact sheets, or presentations, on a daily basis. The Strategy has been implemented by licensees since December 2021. The Strategy contains rules-based methodologies that have been calculated and published since January 2004. All data prior to April 26, 2021, for the Strategy is hypothetical performance as it does not reflect the returns of live accounts utilizing the Strategy. It is “back tested” prior to April 26, 2021, which is calculated by running the Strategy backwards in time on historical data, and “tracked” from April 26, 2021, forward, which is calculated by running the collectively “DAFI™” or the “Strategy” forward on live data. Despite its historical existence, there is not necessarily a correlation (or non-correlation) between the DAFI™ and the Bloomberg US Aggregate Bond Index. DAFI™ is a synthetic functioning representation of volatility and, historically, DAFI™ behaves similarly to the Bloomberg US Aggregate Bond Index. However, these securities/indices are not similar either in composition or element of credit risk, and other risks. Any hypothetical composite of the historical performance of different asset class exposures and rules-based methodologies, such as DAFI™’s strategy, is subject to several material inherent limitations, including that the compositing process was done with the benefit of hindsight. See “Certain Risk Factors” in the Prospectus and any Supplement in respect to DAFI™ (together, the “Memorandum”) and to any securities associated with this material. The information set out this website should be read in conjunction with, and is qualified in its entirety by, the full text of the Memorandum, incorporated by reference to this material as are all other investment strategies, documents and agreements referred to herein for important risk factors and disclosures, and other information on the methodology used and assumptions made in preparing this statistical review. Past performance is not indicative of future potential.

These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.